Impact

| Volunteer Income Tax Preparation – 2024 Filing Season (Spring 2025) |

|---|

|

| Tax Clinic |

|---|

|

Press Releases

Volunteer Income Tax Assistance (VITA) helped South Carolinians with their tax returns

The University of South Carolina Joseph F. Rice School of Law completed its 32nd year serving the South Carolina community through the Volunteer Income Tax Assistance (VITA) program, hosted at the law school for the Spring 2025 tax season. VITA, which is an IRS grant initiative that is part of the law school’s Taxpayer Assistance Program, provides free tax return preparation for low-income taxpayers. Through the program, law student volunteers prepared 257 tax returns, helping taxpayers receive tax refunds for the 2024 calendar year totaling $394,207 (a total of $267,754 in federal refunds, and $126,453 in state refunds).

Law school volunteers prepared tax returns for families including 54 children and 9 other dependents (generally elderly or disabled family members). The volunteers assisted these families in securing an average Child Tax Credit of $2,052 for each family, as well as an average Earned Income Credit of $2,321. The volunteers also assisted 81 Social Security recipients (elderly taxpayers and taxpayers receiving disability payments) with their tax returns.

In addition to the community benefit, law students volunteering with VITA have an opportunity to enhance their legal skills by conducting interviews and working on a real-world application of tax law on behalf of clients.

The program was established at the law school by the former Pro Bono Director, Pam Robinson, and in 2025 was coordinated by Ashley Blas, the Assistant Director of the Taxpayer Assistance Program at Rice School of Law. Blas believes that the VITA program truly embodies the law school’s mission: to use legal education as a tool for justice, service, and community engagement.

“The students gain real-world experience while making a tangible difference in the lives of those who need it most,” Blas says. “Each year, the VITA program reminds us that legal education can be a powerful force for good. It demonstrates that pro bono service is not just an extracurricular activity—it’s central to what legal training should be. Our student volunteers help hardworking individuals navigate a complex tax system and reclaim critical funds that support essentials like food, housing, and family needs. In doing so, they show that they’re not just preparing for legal careers—they’re already making a meaningful impact.”

Three student managers, third year students Brooklyn Withers and Dennard Small, and second year student Bethany Weatherford, provided support to VITA this year. Weatherford believes that the law school’s involvement in the VITA program is a powerful example of the school's dedication to helping our local community.

“It is a privilege to take part is such a hands-on initiative, as we offer a valuable and often complex service completely free of charge to the low-income and elderly community,” Weatherford says. “The most meaningful part of my experience has been connecting with community members and hearing firsthand how much the program has eased their financial concerns and reduced the stress of tax season. The impact of VITA is truly immeasurable, and I am honored to be a part of it.”

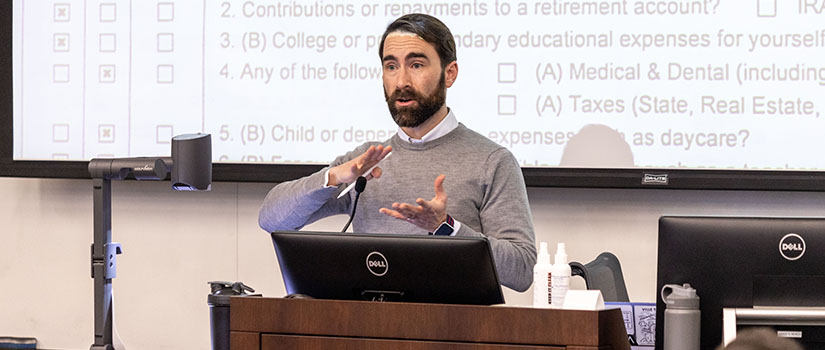

Clint Wallace, Professor of Law and Faculty Director of the Taxpayer Assistance Program, described how the students develop familiarity with the tax system while providing a much-needed community service.

"The VITA program is a unique way for students to do something really similar to the practice of law before they have a law license,” Wallace says. “It's really fun to see them develop their bedside manner and figure out how they can effectively communicate about complicated issues in a way that's comforting, helpful, and positive, and also reflects their understanding of this complicated material.”

VITA will return to assist taxpayers for the 2025 calendar year in Spring 2026, which is anticipated to introduce additional filing complexity on low-income taxpayers seeking to navigate the limited special exemptions for certain tip and overtime income, as well as reducing the refundable portion of the child tax credit from $1700 for 2024 (an amount which was previously inflating-adjusted to increase each year) to $1400 for 2025 and beyond.

More information, including volunteering opportunities and service dates, will be available closer to the start of filing season. Click here for more information about VITA.